The semiconductor industry has been a driving force behind the technological advancements of the 21st century, with its impact felt across various sectors, from consumer electronics to automotive and healthcare. For investors looking to tap into the growth potential of this industry, the Direxion Daily Semiconductor Bull 3X Shares (SOXL) offers an intriguing opportunity. In this article, we'll delve into the details of SOXL, exploring its stock price, quote, and what it means for those looking to invest in the semiconductor sector.

Understanding SOXL: Direxion Daily Semiconductor Bull 3X Shares

SOXL is an exchange-traded fund (ETF) designed to provide investors with a way to gain exposure to the semiconductor industry with a daily investment objective that is leveraged. This means SOXL aims to return 300% of the daily performance of the PHLX Semiconductor Index (SOX), before fees and expenses. The SOX Index is a modified market-capitalization-weighted index composed of companies involved in the design, distribution, manufacture, and sale of semiconductors.

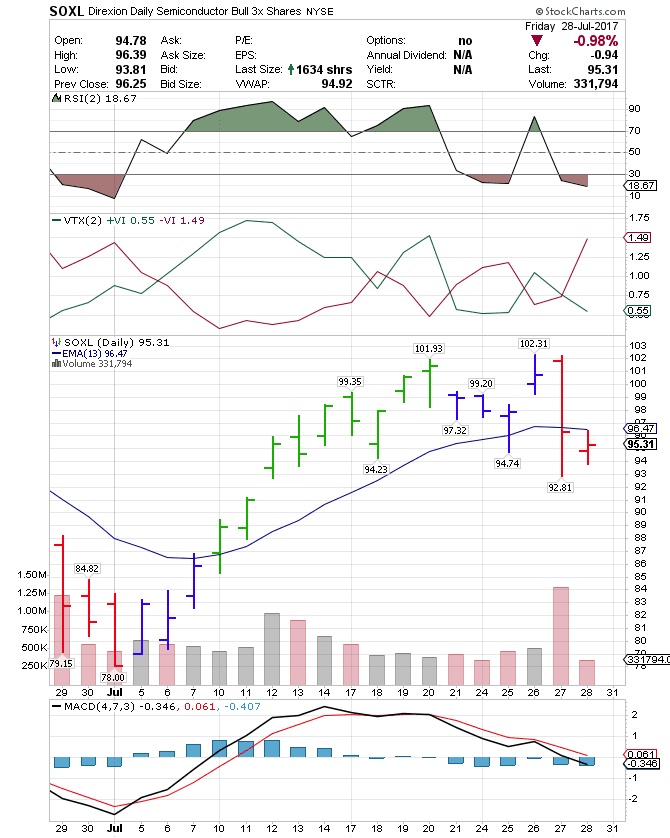

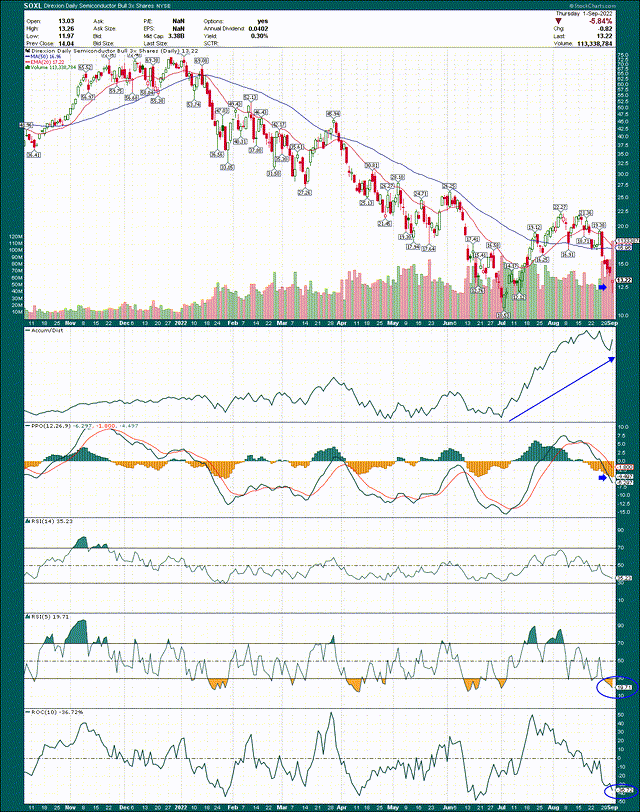

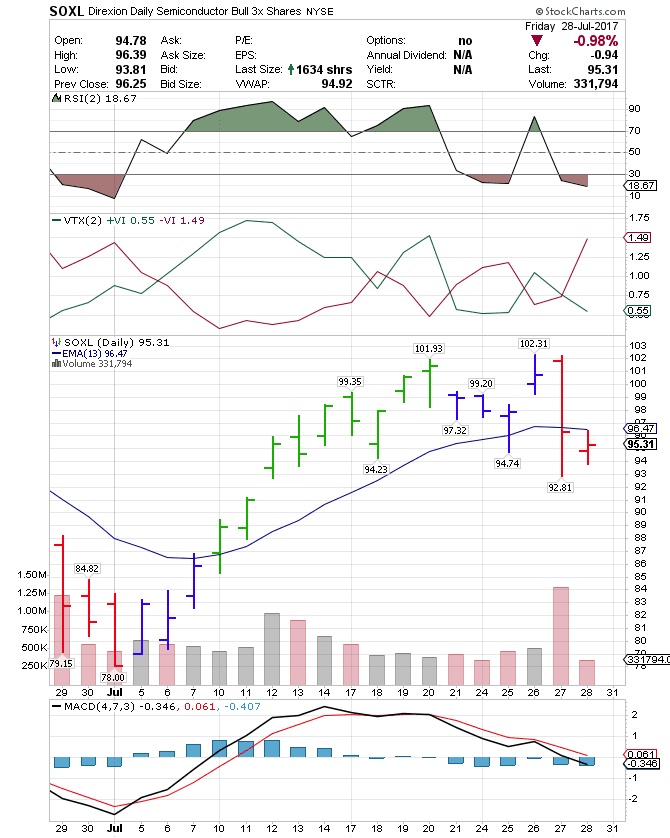

Stock Price and Quote: Tracking SOXL's Performance

Investors interested in SOXL can track its stock price and quote in real-time through various financial platforms and websites. The stock price of SOXL reflects the fund's net asset value (NAV) and is influenced by the performance of the underlying securities in the SOX Index. Given its leveraged nature, the price of SOXL can be more volatile than non-leveraged ETFs, offering the potential for higher returns but also higher risks.

Investment Considerations

For investors considering SOXL, it's essential to understand the risks and benefits associated with a leveraged ETF. Here are a few key points to consider:

-

Volatility: SOXL's leveraged strategy means its price can fluctuate significantly, even over short periods. This volatility can result in substantial gains but also considerable losses.

-

Daily Reset: The fund's objective is to achieve its investment goal on a daily basis, which means the impact of compounding can be significant over longer periods. This can lead to results that differ from the fund's stated multiple over periods other than a single day.

-

Fees and Expenses: Like all investment products, SOXL comes with fees and expenses. These can eat into your returns, especially if you're holding the fund over an extended period.

The Direxion Daily Semiconductor Bull 3X Shares (SOXL) offers investors a unique way to capitalize on the growth potential of the semiconductor industry with a leveraged approach. While it presents opportunities for significant gains, it's crucial for investors to understand the volatility and risks associated with leveraged ETFs. By carefully considering these factors and conducting thorough research, investors can make informed decisions about whether SOXL aligns with their investment goals and risk tolerance.

For those looking to dive deeper into the semiconductor sector or seeking to leverage the potential of this rapidly evolving industry, SOXL is certainly worth exploring further. With its focus on a segment that underpins modern technology, SOXL represents an exciting opportunity for investors eager to stay at the forefront of technological advancements.

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as investment advice. It's always recommended to consult with a financial advisor before making any investment decisions.